Payroll tax estimator 2023

The maximum an employee will pay in 2022 is 911400. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

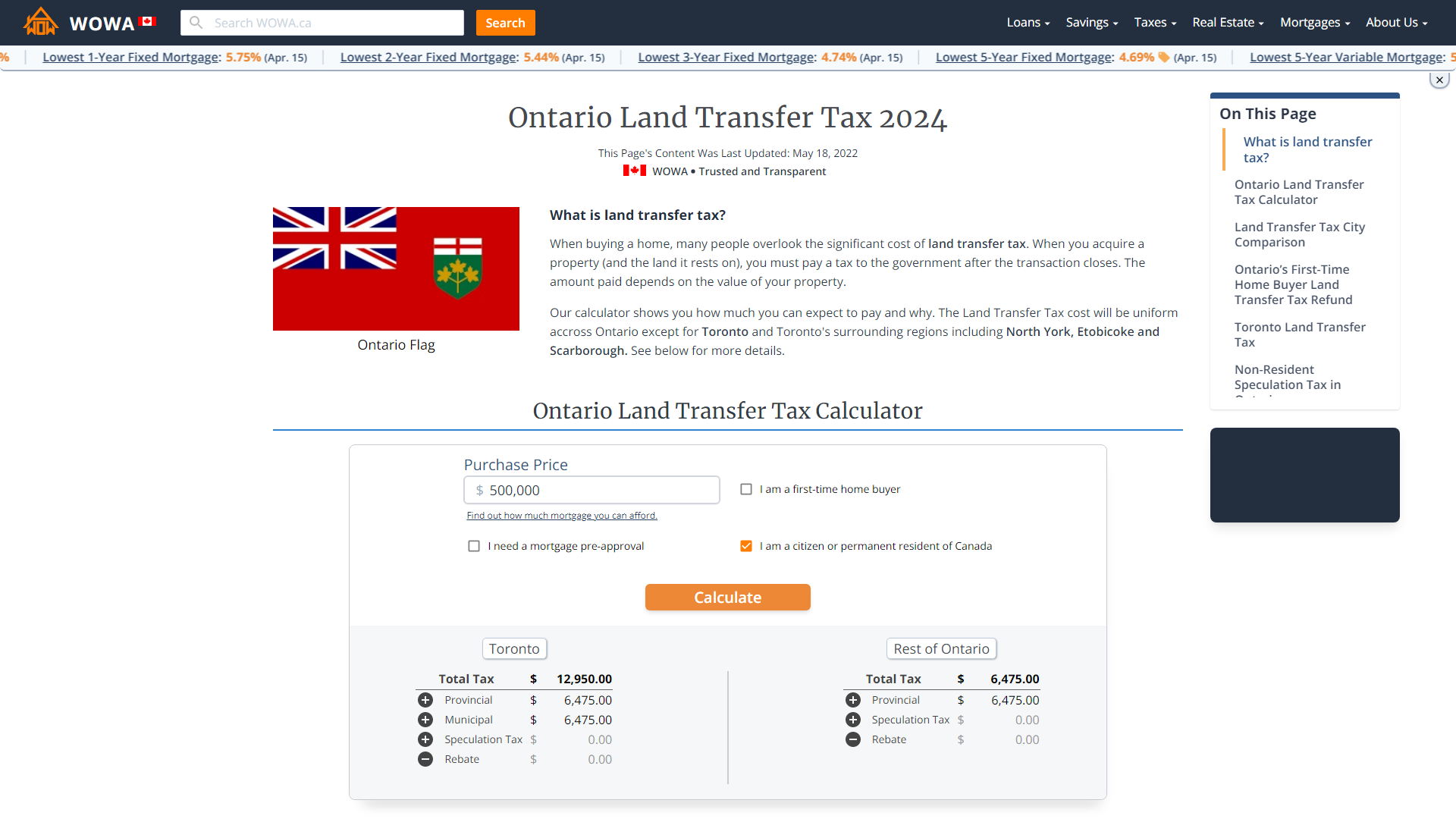

Ontario Land Transfer Tax 2022 Calculator Rates Rebates

Use our PAYE calculator to work out salary and wage deductions.

. Multiply taxable gross wages by the number of pay periods per. Get Started With Limited Offers Today. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to.

I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay. Answer a few simple questions. In Fiscal Year 2023 in keeping with the usual practice contractual employees.

Your average tax rate is 1198 and your marginal tax rate is. UK PAYE Tax Calculator 2022 2023 The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Use this simplified payroll deductions calculator to help you determine your net paycheck.

It will confirm the deductions you include on your. Get Started With Limited Offers Today. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Please enter your salary into the Annual Salary field and. Tax Calculator Return Refund Estimator 2022-2023 HR Block How it works. Ad Simplify Your Payroll.

Both you and your employee will be taxed 62 up to 788640 each with the current wage base. Your employees FICA contributions should be deducted from their wages. Focus on Running your Business with the Right Payroll Solutions.

See where that hard-earned money goes - with UK. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Customers need to ensure they.

Free 2022 Employee Payroll Deductions Calculator. Most Americans are required to pay federal income taxes but the amount. It will confirm the deductions you.

Indiana payroll calculator 2023 Rabu 07 September 2022 FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount. Free Unbiased Reviews Top Picks. The payroll tax rate reverted to 545 on 1 July 2022.

For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000. 2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. The calculator above can help you with steps.

Daily Weekly Monthly Yearly. Estimate your federal income tax withholding. This simplified ATO Tax Calculator will calculate your annual monthly fortnightly and weekly salary after PAYG tax deductions.

Withholding schedules rules and rates are. Use this payroll tax calculator to help get a rough estimate of your employer. By default the US Salary Calculator uses the latest tax information as published by the IRS and individual.

Ad Take Advantage of Everything Payroll Has To Offer. Free Unbiased Reviews Top Picks. Income Tax Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year.

Focus on Running your Business with the Right Payroll Solutions. 2023 payroll tax calculator Thursday September 8 2022 An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

State Disability Tax provides temporary funding for non-work related disabilities as well as paid family leave for those caring for an ill family member or bonding with their. Use this calculator to quickly estimate how much tax you will need to pay on your income. Use this tool to.

The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay. See how your refund take-home pay or tax due are affected by withholding amount. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Ad Take Advantage of Everything Payroll Has To Offer. Over 900000 Businesses Utilize Our Fast Easy Payroll. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

Ad Compare This Years Top 5 Free Payroll Software. Find out the estimated tax. Use our employees tax calculator to work out how much PAYE and UIF tax you.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Australia has a progressive tax system which means. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Ad Compare This Years Top 5 Free Payroll Software.

![]()

Canada Income Tax Calculator 2022 With Tax Brackets Investomatica

2021 2022 Income Tax Calculator Canada Wowa Ca

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Health Insurance Tax Health Insurance Infographic Infographic Health Health Care Reform

Capital Gains Tax Calculator 2022 Casaplorer

Simple Tax Calculator For 2022 Cloudtax

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

Manitoba Income Tax Calculator Wowa Ca

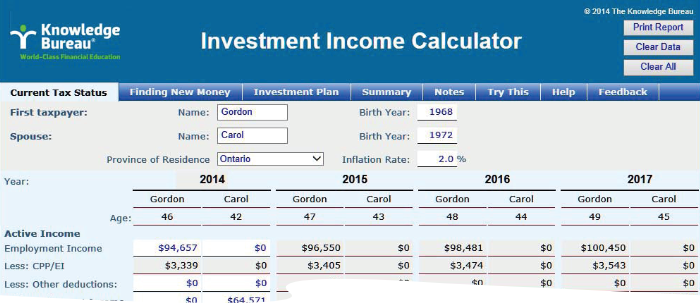

Knowledge Bureau World Class Financial Education

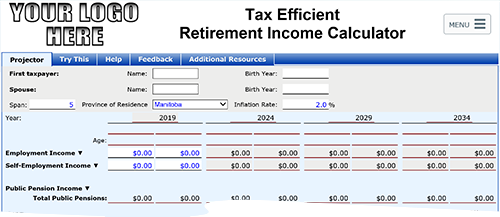

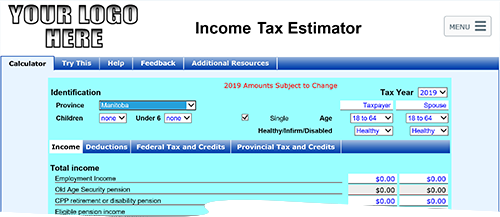

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Knowledge Bureau World Class Financial Education

Knowledge Bureau World Class Financial Education